Getting The Personal Loans copyright To Work

Getting The Personal Loans copyright To Work

Blog Article

The Definitive Guide for Personal Loans copyright

Table of ContentsExcitement About Personal Loans copyright5 Simple Techniques For Personal Loans copyrightLittle Known Questions About Personal Loans copyright.The 5-Minute Rule for Personal Loans copyrightSome Known Facts About Personal Loans copyright.

Doing a regular budget will certainly provide you the self-confidence you require to manage your cash efficiently. Great things come to those that wait.Saving up for the big points means you're not going into debt for them. And you aren't paying extra over time because of all that rate of interest. Trust fund us, you'll delight in that family members cruise ship or play area collection for the children way a lot more understanding it's currently paid for (as opposed to making payments on them up until they're off to college).

Absolutely nothing beats peace of mind (without financial obligation of program)! You do not have to transform to individual financings and debt when points obtain tight. You can be complimentary of financial debt and begin making real grip with your cash.

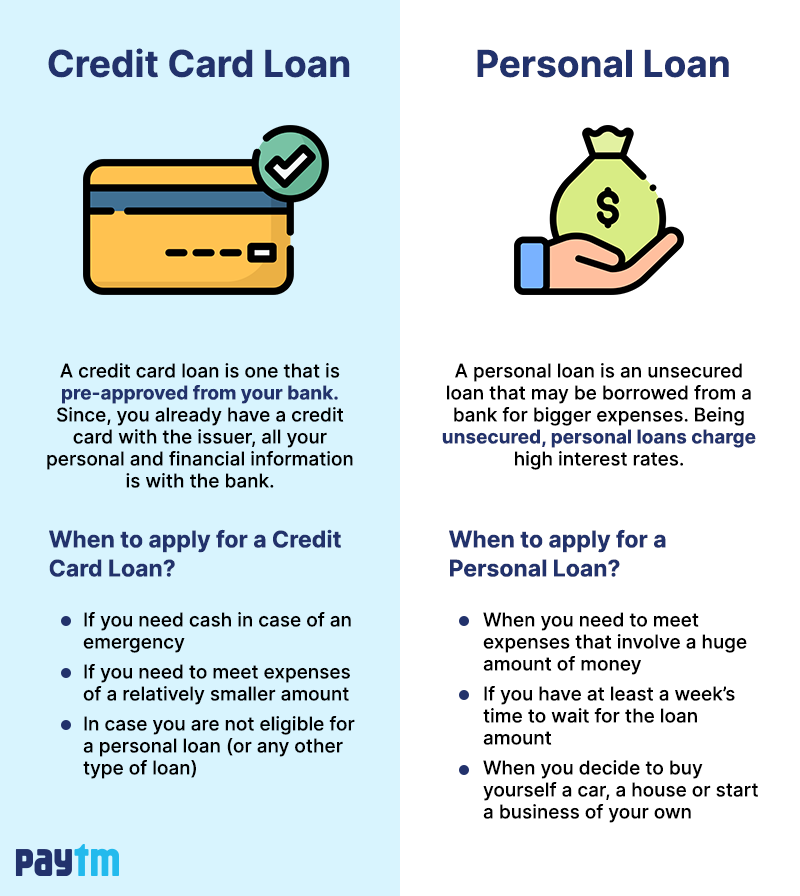

An individual lending is not a line of credit history, as in, it is not revolving financing. When you're authorized for an individual funding, your lender offers you the complete amount all at when and then, generally, within a month, you begin repayment.

The Of Personal Loans copyright

Some banks placed stipulations on what you can make use of the funds for, yet several do not (they'll still ask on the application).

At Springtime, you can use regardless! The demand for personal fundings is increasing among Canadians curious about leaving the cycle of cash advance, combining their financial debt, and rebuilding their credit history. If you're requesting an individual financing, right here are some things you must maintain in mind. Individual loans have a fixed term, which indicates that you recognize when the debt has actually to be repaid and just how much your repayment is on a monthly basis.

Getting My Personal Loans copyright To Work

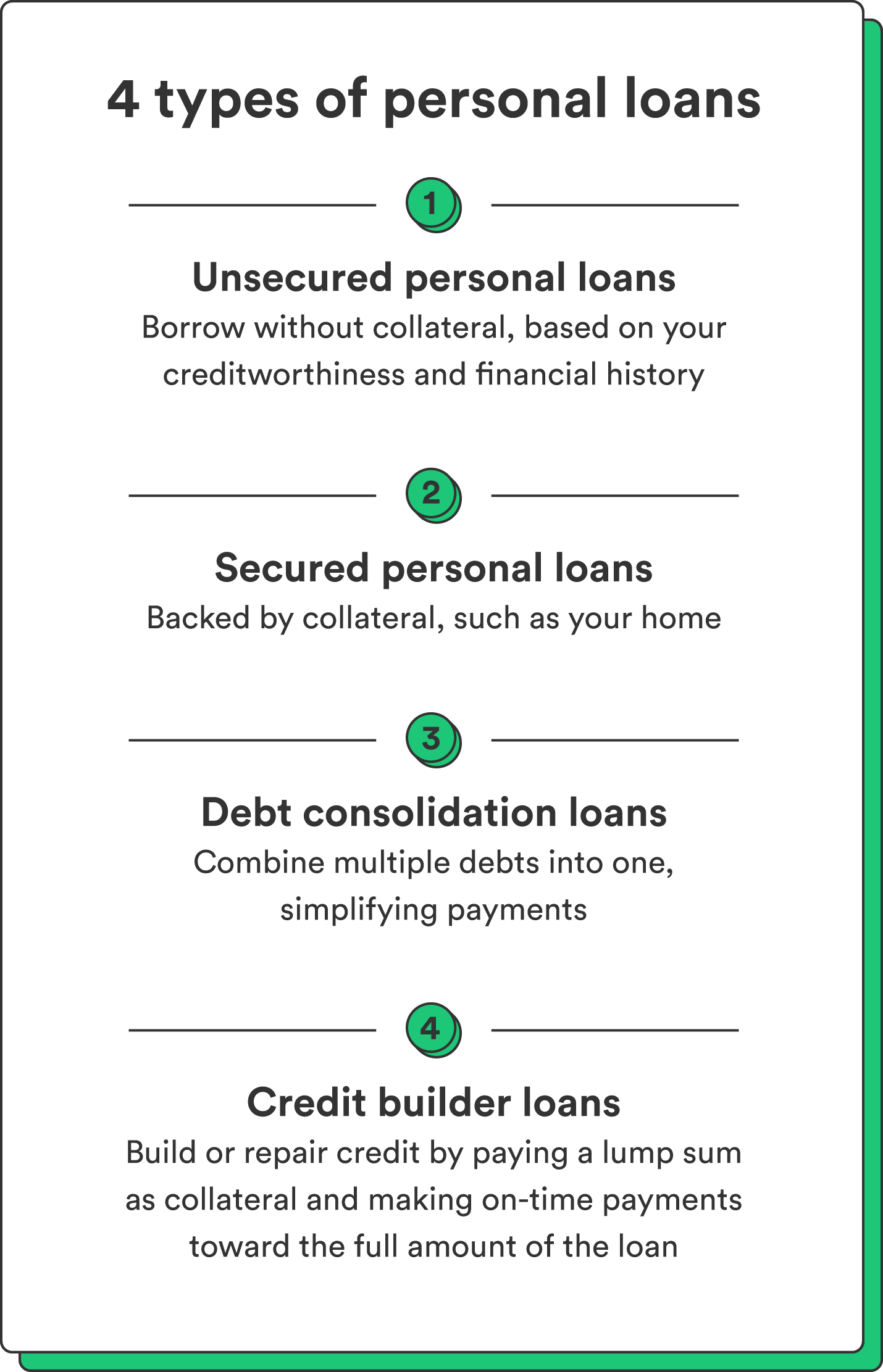

Additionally, you might be able to decrease just how much overall interest you pay, which indicates even more cash can be conserved. Individual car loans are effective devices for developing up your credit rating. Payment history accounts for 35% of your credit score, so the longer you make routine payments in a timely manner the a lot more you will see your rating increase.

Individual finances offer a great possibility for you to rebuild your credit top article score and pay off financial obligation, yet if you don't budget plan correctly, you might dig yourself right into an also deeper hole. Missing out on one of your month-to-month settlements can have an adverse effect on your credit rating but missing out on a number of can be ravaging.

Be prepared to make every repayment promptly. It holds true that an individual car loan can be made use of for anything and it's simpler to obtain approved than it ever remained in the past. If you do not have an immediate requirement the additional cash money, it may not be the ideal service for you.

The fixed regular monthly settlement quantity on a personal funding relies on just how much you're borrowing, the interest rate, and the set term. Personal Loans copyright. Your interest price will certainly rely on factors like your credit rating and income. Most of the times, personal financing rates are a lot reduced than debt cards, but sometimes they can be greater

The 5-Minute Rule for Personal Loans copyright

Rewards consist of excellent passion prices, unbelievably quick processing and funding times & the anonymity you might desire. Not everyone likes walking into a financial institution to ask for money, so if this is a difficult place for you, or you just don't have time, looking at on-line lenders like Spring is a terrific alternative.

That greatly depends upon your ability to repay the amount & benefits and drawbacks exist for both. Repayment sizes for personal fundings generally fall within 9, 12, 24, 36, 48, or why not look here 60 months. Often longer settlement periods are a choice, though unusual. Shorter payment times have really high month-to-month repayments but after that it's over swiftly over at this website and you don't lose even more cash to interest.

The Main Principles Of Personal Loans copyright

You could get a lower rate of interest price if you fund the funding over a shorter duration. An individual term car loan comes with a concurred upon repayment schedule and a dealt with or drifting passion price.

Report this page